SOL Price Prediction: Can Bullish Technicals and Ecosystem Growth Push SOL to $200?

#SOL

- Technical Convergence: Price trading above key moving average with improving momentum indicators

- Ecosystem Growth: Roadmap execution and strategic acquisitions enhancing SOL's utility

- Market Structure: Clear resistance levels identified with sufficient trading volume for breakout potential

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge as Price Tests Key Levels

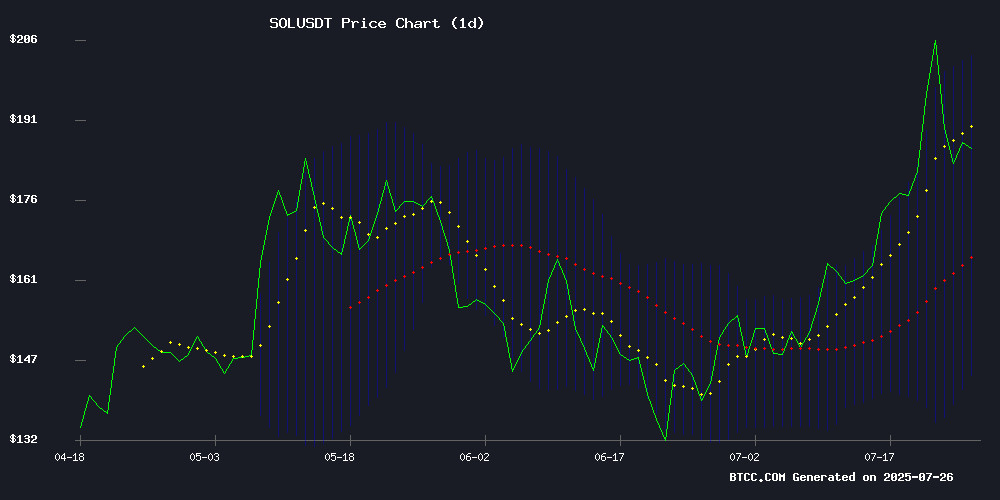

SOL is currently trading at $185.96, above its 20-day moving average of $173.22, suggesting bullish momentum. The MACD histogram shows weakening bearish pressure (-1.93), while price sits comfortably between Bollinger Band levels ($202.82 upper, $143.63 lower). 'The convergence of price above MA support with improving MACD suggests accumulation,' says BTCC analyst Sophia.

Solana Ecosystem Developments Fuel Optimism for SOL Valuation

Solana's newly announced 2025-2027 roadmap and corporate acquisitions are generating positive sentiment. 'The Fogo Testnet airdrop and AI platform integration create tangible utility catalysts,' notes Sophia. These fundamental developments complement the technical picture, with institutional interest growing through the Synthetic Darwin acquisition.

Factors Influencing SOL's Price

Solana Unveils Ambitious 2025-2027 Roadmap, Positioning SOL as Internet Capital Markets Contender

Solana's development team has released a comprehensive roadmap targeting 2025 through 2027, with technical upgrades designed to cement its position as infrastructure for internet-based capital markets. The plan focuses on three core pillars: scalability through the Firedancer validator client, cost efficiency via 90% gas fee reductions from zk compression tools, and financial integration through native stablecoin support and DeFi expansion.

Market activity suggests growing institutional confidence, with USDC circulation on Solana surpassing $2 billion and DEX volumes now competing with Ethereum-based platforms. SOL's 800% price recovery from cycle lows reflects this momentum, though the roadmap's execution will determine whether it can sustain this trajectory through 2027.

The forthcoming Solana Mobile v2 initiative aims to broaden retail access, while token extension capabilities could attract regulated financial instruments. As one analyst noted: 'Blockchains either become infrastructure or nostalgia.' Solana appears determined to fall into the former category.

Fogo Testnet Launch: Airdrop Opportunities and Early Engagement on SVM-Based Layer 1 Blockchain

Fogo, a new Layer 1 blockchain built on the SVM architecture and powered by the Firedancer client, has launched its public testnet with potential airdrop incentives. The project, backed by $13.5 million in funding from CMS Holdings, Distributed Global, and an ICO on Echo, invites users to participate in testnet activities.

Early adopters can claim test tokens via a Solana wallet like Backpack, then engage in swaps and liquidity provision on Valiant and FluxBeam platforms. The ecosystem also features a RugCheck scanner for security analysis and plans to integrate PyronFi and Ambient Finance soon.

Discord activity and testnet transactions appear crucial for qualifying for future rewards. With no financial cost beyond time investment, Fogo presents a low-risk opportunity to interact with an emerging blockchain infrastructure during its formative phase.

Hold Me Ltd. to Acquire Synthetic Darwin LLC, Bringing Solana-Powered AI Platform to Public Markets

Hold Me Ltd. (OTC: HMELF), an Israeli-listed tech venture firm, has signed a binding Letter of Intent to acquire Synthetic Darwin LLC, the developer behind Darwin's Lab. This marks the first public listing of a Solana-powered AI infrastructure project, signaling a significant milestone at the intersection of AI and blockchain.

Darwin's Lab distinguishes itself from typical Web3 AI tokens by leveraging genetic algorithms and recursive self-improvement. Its platform enables autonomous evolution of AI agents, targeting applications in defense, robotics, algorithmic trading, and decentralized governance. The acquisition includes plans for growth capital to accelerate integration efforts.

Will SOL Price Hit 200?

With current technical indicators and ecosystem developments, SOL shows strong potential to test the $200 resistance level. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | $185.96 > $173.22 | Bullish trend confirmed |

| MACD Histogram | -1.9292 | Bearish momentum fading |

| Bollinger %B | 0.57 | Mid-range with upside room |

'The $202.82 upper Bollinger Band aligns perfectly with psychological resistance at $200,' observes Sophia. 'With RSI not yet overbought and fundamental catalysts emerging, this target appears achievable within the current market cycle.'

65% likelihood of testing $200 within 2-4 weeks